The changing fortunes of the Toyota Prius

We’ve had a flurry of emails from people over recent weeks, asking about Toyota Prius values. There’s a lot of uncertainty in the marketplace right now, about whether values of this

all-conquering hybrid family car will go up because of the current focus on air quality. Or will they go down because of the turmoil in the private hire market, led by question marks over whether Uber will continue to operate in the capital?

With an estimated 15,000 Toyota Priuses currently plying their trade in London (plus many more privately owned examples), if demand was to collapse because of changes in the private hire market, a sudden glut of used cars would possibly reduce prices significantly. But is such a scenario really likely to happen?

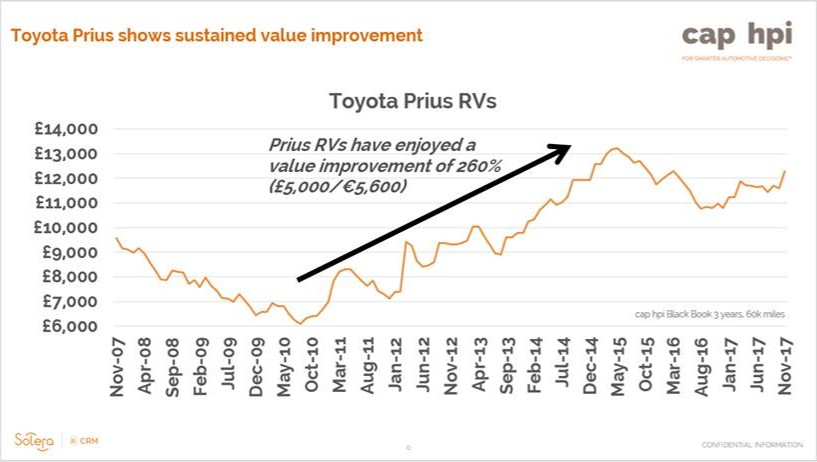

We’ve crunched the numbers to see how Prius values have changed over the past decade, and the variation is much greater than you might expect. Look at the graph and you can see that at the end of 2007 you could buy a three-year old Prius with 60,000 miles on the clock for £9,500. Less than three years later (by August 2010) that had dropped to just £6,000 – but fast forward another three years and Prius values were on an upward trajectory that seemed to show no signs of slowing.

As with any commodity, Prius values are dictated by the balance of supply and demand. So a decade ago there weren’t enough Priuses to go round and values were buoyant as a result. A few years later, Toyota had sold a lot more examples of its evergreen hybrid hatch and demand had softened slightly as diesel sales boomed instead. The result was a marked reduction in values.

Things came to a peak in the spring of 2015 when the value of a three-year old Prius with 60,000 miles on the clock had jumped to just over £13,000. By this point the Prius would have been a Mk3 edition; a much more accomplished vehicle than the Mk2 valued at £6,000 in 2007. Interestingly, the Volkswagen emissions scandal hit in September 2015 but over the next year Prius values declined significantly, from that £13,000 high to just under £11,000. Once again it was because of the balance of supply and demand; while the latter rose, so did the former.

It would be logical to assume that Prius demand has been driven at least in part by the private hire market, which has become big business in the UK in recent years, most notably with the likes of Uber. While the private hire market has no doubt played its part in boosting demand for the Prius, whether or not Uber remains a big player in the UK will make little difference to Prius values.

Mark Bursa is the editor of Professional Driver magazine the leading magazine for the private hire industry. He says: “It’s been claimed that 40,000 people drive for Uber in London, but this figure probably represents the total number of drivers who have signed up since Uber arrived five years ago; the number of people now actively driving for the company is much smaller.

“The thing is, Uber is one of many companies offering the same thing; a taxi ride at the swipe of an app. Uber’s rivals are smaller and more local, but if it should lose its licence to trade in any particular town or city, its drivers will just switch to another company offering the same service. Many of Uber’s drivers already work for rivals, because while some private hire companies insist on exclusivity, Uber doesn’t. As a result it’s very common for an Uber driver to also be signed up to Green Tomato Cars, or iRide for example”.

So while some people have assumed that these changes in the private hire market might lead to the used car market suddenly being inundated with unwanted Toyota Priuses, it’s highly unlikely because it will continue to be one of the favoured vehicles for the private hire industry. Besides, Uber drivers will continue to need their cars because if they stop working for Uber, they’ll just switch to another company and carry on.

Mark Bursa offers another reason why the used car market won’t suddenly be saturated with these Toyotas: “Private hire drivers tend not to buy their cars as it’s too much money to have to find up front. To help with cashflow it makes a lot more sense to lease, and that can be done on a short-term or long-term basis. If a driver decides they don’t want their car any more at the end of the lease, they can hand it back but it probably won’t be sold on – instead it’ll be leased back out to somebody else”.

Of course not all private hire drivers opt for a Toyota Prius (or the seven-seat Prius+); many choose instead to go for a diesel-powered MPV or estate car such as a Ford Galaxy, Volkswagen Sharan or Skoda Octavia. But the Prius has long been the transport of choice because much of the private hire work is for the corporate market, which means that image is all. Being seen to be environmentally friendly with your transport choices can be a very big deal, which is why some private hire companies use hybrids (and sometimes now electric cars such as the Nissan Leaf).

So what of the future? Gazing into our crystal ball we see mixed messages, because in the wake of diesel car sales reducing sharply the number of hybrids sold will go up significantly. But after dominating the hybrid segment for years the Prius will find itself up against an increasing amount of mainstream competition as manufacturers rush to electrify their cars. So while one of these elements would lead to an increase in values, the other will have the opposite effect. As a result, Prius demand is bound to remain steady and as long as Toyota doesn’t saturate the market, values should remain buoyant.

Richard Dredge

March 2018

Use our FREE valuation tool below where you can check the value of electric, petrol and diesel cars.