Hidden Danger: Insurance Write-off Categories Explained

When choosing a pre-owned vehicle to purchase, how do you really know what you’re getting yourself into — both literally and figuratively? What you don’t know may hurt you when it comes to a vehicle’s hidden past, most notably when it comes to write-offs. Cars get written off by insurers because they’re either so damaged they’re not safe to drive or will cost more to fix than what they’re worth. Either way, a write-off is something you typically want to avoid.

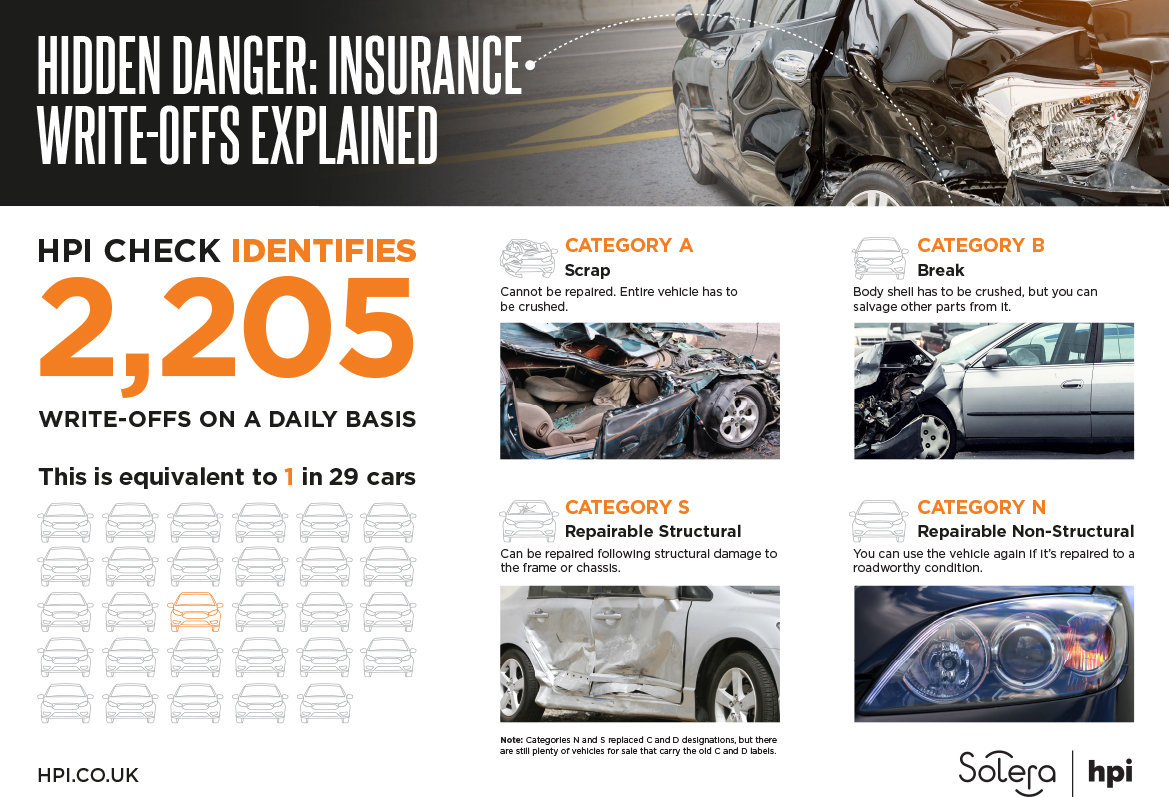

On a daily basis, HPI Car Check data identifies 2,205 cars as insurance write-offs just as those vehicles are presumably being considered for purchase. Unwittingly buying an insurance write-off can have serious safety and financial implications, beyond just paying an artificially inflated cost. That’s why it’s important to understand how the system works.

When an insurance claim is filed on a car after an accident, fire damage or theft, it’s assessed by the insurance company to determine whether it’s worth repairing. Car insurance assessors follow a Salvage Code produced and supported by the Association of British Insurers and designed to protect the public, detect and deter insurance fraud and other criminal activities and to make vehicle histories more transparent.

In October 2017, new insurance write-offs came into effect to reflect the rising complexities involved in repairing today’s vehicles. Categories N and S replaced C and D designations, but there are still plenty of vehicles for sale that carry the old C and D labels. Today, buyers considering vehicles that have been damaged will get a better sense of the impact, plus the V5C is now marked with an S to denote a salvaged vehicle. The code requires all salvaged vehicles to be categorized as listed below.

Write-off Categories

A – Scrap

Unsuitable or beyond repair and has been identified to be crushed in its

entirety, including otherwise salvageable parts. These are cars that have been

damaged so badly, they’re not safe to be put back on the road. They must be

completely destroyed.

B – Break

Unsuitable or beyond repair. The body shell has to be crushed, but other parts

can be recycled/resold, such as wheels and seats — even the engine.

S – Repairable Structural

Can be repaired following structural damage to the frame or chassis. The

vehicle can be used again if it’s repaired to a roadworthy condition. Cars in

this category must be re-registered with the DVLA before becoming road-worthy

again.

N – Repairable Non-Structural

Can be repaired following nonstructural damage, so the problem could possibly

be cosmetic, or electrical (e.g., lights, heated seats or an entertainment

system) and too costly to repair. However, there may still be some safety

critical items that require replacement such as steering and suspension parts. Insurance

companies can sell write-offs in the S and N categories back to the original

owner or to a third party through a vehicle salvage company. It’s the

responsibility of the keeper to notify DVLA when a Category S vehicle is passed

to an insurer following a total loss payment, but no notifications are made

when a Category N car is written off.

C

Can be repaired, but it would cost more than the vehicle’s worth. The vehicle

can be used again if it’s repaired to a roadworthy condition.

D

Can be repaired and would cost less than the vehicle’s worth, but other costs

(such as transporting your vehicle) take it over the vehicle’s value. The

vehicle can be used again if it’s repaired to a roadworthy condition.

Cars in these categories can sometimes be a bargain. An older car can occasionally be safely repaired at a lower standard than dictated by an insurance company using less expensive labor or used parts. But, buyer beware. Know that insurance can be harder to come by for cars that have been written-off, and some insurers refuse to cover them at all. For categories C, D, S and N, expect higher premiums and a lower resale value when you’re ready to sell.

At any rate, it’s worth getting a thorough mechanical inspection from a qualified mechanic before buying a car because, unfortunately for the typical buyer, it can be difficult to distinguish a write-off on sight. And, as for the seller, well he may or may not be knowingly exploiting his customers. Although some sellers may attempt to disguise Category N or S vehicles as undamaged by hiding their past.

One way to know what you’re getting yourself into is to use an HPI Car Check to scrutinise the history of any motorised vehicle registered in the UK, including cars, vans and motorbikes. The comprehensive check alerts you to any troubling information held against the vehicle by finance and insurance companies, the DVLA, police and other industry bodies. While an HPI Car Check can alert you to an insurance write-off if the insurance company has declared it a total loss or the DVLA has marked it as scrapped, there are a lot of other red flags you’ll want to be aware of.

As a matter of fact, one in three vehicles has a hidden issue. It could be that the car has been stolen or has a stolen V5C, has outstanding debt attached to it, has been clocked to display reduced mileage, has had its number plates changed to hide its history … the list goes on.

So be sure to protect yourself with good quality, trusted data from a reliable source.

For more information about the HPI Check and how you can protect yourself when buying a used car, visit www.hpi.co.uk